Generally, this is the same bank account that is created in QuickBooks for reflecting the actual bank account where the funds are being deposited and fees being withdrawn.įor viewing the deposit options in newer QuickBooks versions, users must navigate to ‘Record Merchant Service Deposits’ and then select ‘Change your deposit settings’ at the bottom. Users will also have to select an expense account for assigning the fees and withdrawing them from.

#Receiving payments and making deposits in quickbooks desktop for mac download#

In order to download ‘Merchant Service Deposits and Fees’, users must select an account for downloading them into. For ‘Chart of Accounts’: ‘Create’, ‘Modify’ and ‘View Account Balance’Ĭonfiguring deposit and fees account settings in QuickBooks.To fix it, QuickBooks administrator must give the user these permissions:

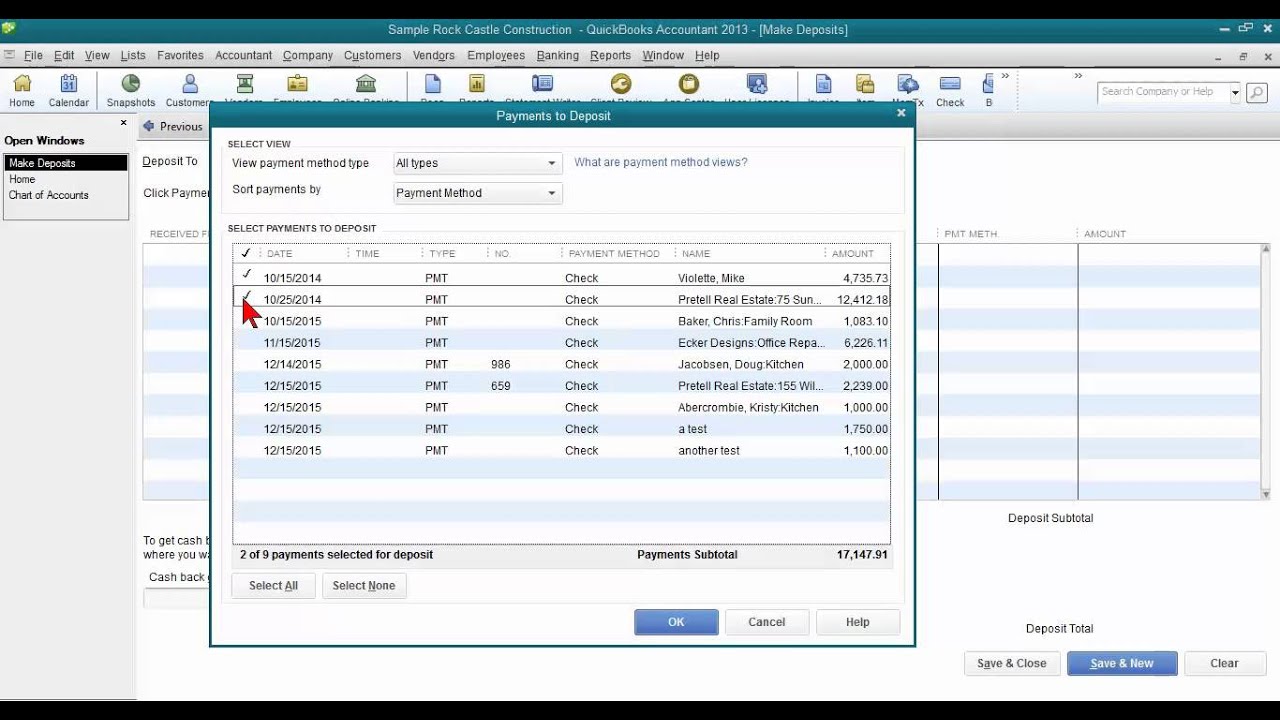

This error is due to insufficient QuickBooks user permissions. Resolving error: ‘To make a deposit, you need a valid expense account’ Make sure that your bank statement and amount in QB is matching.The batch won’t get recorded if there are one or more transactions in a batch in this tab.This tab displays the Manually recorded transactions.You can easily manage or reveal all those transactions.This tab displays completely recorded transactions.Then will get a message mentioning the transaction not added.In any case you don’t get all the recorded transactions in a batch.After that the batch will be visible on the ready to Record tab.In the first step compare and record all the transactions in a batch.Then move to the customer menu and then choose the receive payment.After this step, I will need to apply payments to the invoice.After that create an invoice by selecting Need Invoice.You can do it by selecting the multiple payment and after that add the selected payment.After that match the existing payment.Firstly from the Action field choose the Add payment option.If required then you can manually add the payment Now, select ‘Pay Selected Bills’ for completing the process, which will open a confirmation window. (If there are several bank accounts, users must select the bank that the fees were withdrawn from.) In the ‘Vendors’ drop-down, choose ‘Pay Bills’ and the bill that has been created will appear. Next, it must be ensured that the correct date is entered for the date of fee and then users must select ‘Save & Close’ button for completing the bill. Now, users must provide the fee amount in the ‘Amount Due’ section (this amount must also appear in the amount field below). Next, it must be ensured that the proper expense account is listed in the ‘Account’ section. In the ‘Enter Bill’ window, users must choose the vendor allocated for Intuit merchant service account (if it’s not listed, choose ‘Add New’). Users must go to ‘Vendor’-> ‘Enter Bill’ in QuickBooks. Missing fees: Users must create the corresponding bill for entering the missing fee.Then, users must select ‘Make Deposits’ for moving the items to the bank account and completing the reconciliation. Next, the items to be reconciled must be highlighted. Missing deposits: Users must navigate to the ‘Banking’ drop-down menu in QuickBooks and choose ‘Make Deposits’.Manually recording missing deposits and fees Now, all the payments in the batch must be selected and then users must choose ‘Save & Close’.

When the payment is received, users must select ‘Banking’-> ‘Make Deposits’. Users must select ‘Customers’ -> ‘Receive payments’ in QuickBooks and make an entry of the transaction. Recording Merchant Service Deposits Manually recording transactions Then, users must try to download again by selecting the ‘Record all selected card deposits’ button. Now, choose ‘Banking’ and then ‘Record Merchant Services Deposits’. Users must select OK, exit QuickBooks, restart the computer and reopen QuickBooks.

0 kommentar(er)

0 kommentar(er)